Page Content: Synopsis – Introduction – Main – Insights, Updates

Synopsis: This information provides a comprehensive breakdown of Social Security and Supplemental Security Income payment schedules for 2026, sourced from official Social Security Administration payment calendars. The guide is authoritative because it references the SSA’s published payment dates and includes verified details about the 2.8% cost-of-living adjustment taking effect in January 2026. This resource proves particularly useful for seniors and people with disabilities who rely on these monthly payments for essential living expenses, as knowing exact payment dates allows for better financial planning, helps avoid late fees on bills, and reduces anxiety about when funds will arrive. The article explains the birthday-based payment system for Social Security benefits, the first-of-month schedule for SSI recipients, and the exceptions that occur when payment dates fall on weekends or federal holidays, making it a practical reference tool for the 75 million Americans who depend on these programs – Disabled World (DW).

If you’re one of the 75 million Americans who depend on Social Security or Supplemental Security Income, knowing exactly when your check arrives can make budgeting much easier. The Social Security Administration has released its official payment schedule for 2026, and there are a few key dates to mark on your calendar.

The timing of your Social Security payment depends on a few factors: when you first started receiving benefits, your birth date, and whether you receive SSI along with Social Security.

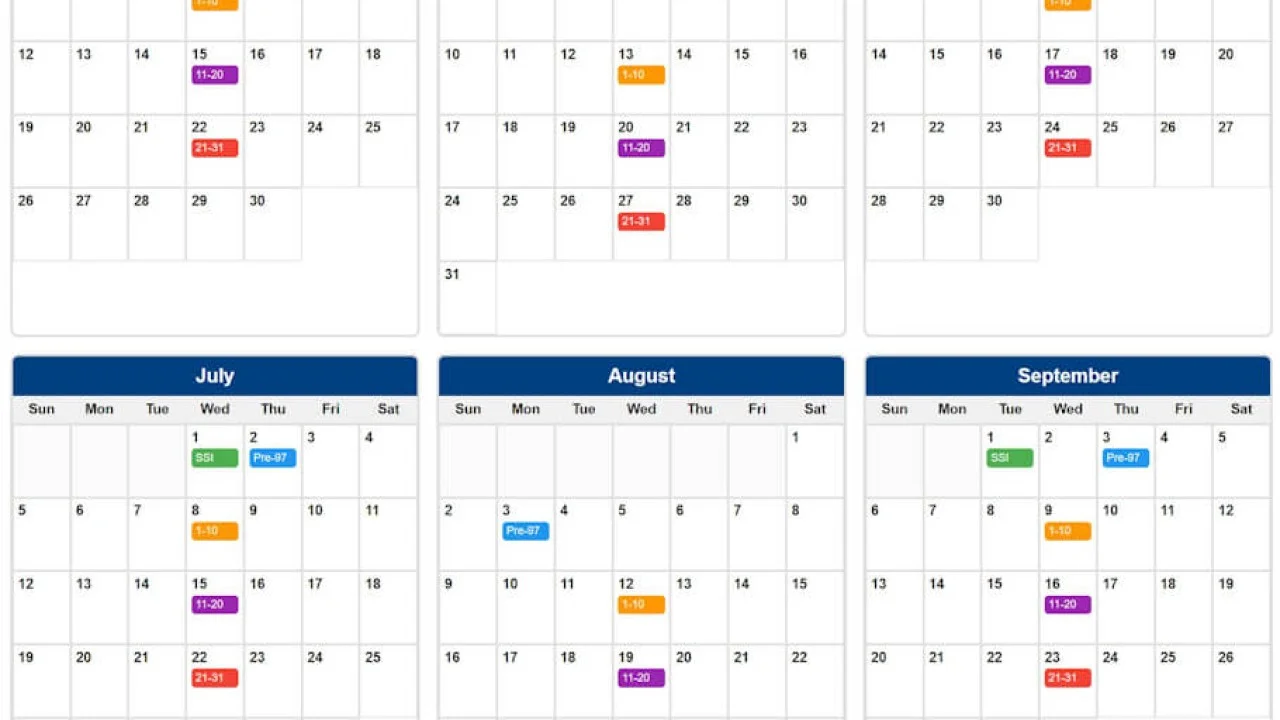

For most people who began receiving Social Security after May 1997, payments arrive on Wednesdays. The specific Wednesday depends on your birthday:

There are exceptions to this schedule. If you started collecting benefits before May 1997, or if you receive both Social Security and SSI, your Social Security payment comes on the third of each month instead of following the birthday-based schedule.

Supplemental Security Income follows a simpler pattern. SSI recipients receive their payments on the first day of every month. However, when the first falls on a weekend or federal holiday, the payment shifts to the last business day before that.

This scheduling quirk creates some interesting situations. For instance, SSI recipients will receive two payments in December 2025 because January’s payment arrives early on December 31. Don’t worry – this isn’t a bonus. It’s just the normal January payment arriving a day early since New Year’s Day is a federal holiday.

Here’s when you can expect your benefits throughout the year:

Starting with benefits paid in January 2026, all Social Security and SSI payments will include a cost-of-living adjustment of 2.8%. For the typical retiree, this means an extra $56 per month, bringing the average retirement benefit to about $2,071 monthly.

SSI recipients will see the increase reflected in their December 31, 2025 payment (which is actually the January benefit), while most Social Security recipients will notice the bump in their January 2026 payment.

The increase is calculated based on inflation data from the third quarter of 2025 compared to the same period in 2024. While this adjustment helps benefits keep pace with rising costs, many recipients find it doesn’t fully cover their increased expenses, particularly for healthcare, housing, and groceries.

Normally, payments arrive on schedule through direct deposit or on a Direct Express card. If your payment doesn’t show up on the expected date, the Social Security Administration recommends waiting three additional business days before reaching out. Sometimes banks process deposits at different times, or there may be a slight delay in the system.

If the payment still hasn’t arrived after those three days, you can contact the Social Security Administration at 1-800-772-1213 (TTY 1-800-325-0778) Monday through Friday, 8 a.m. to 7 p.m. local time.

You can also check your payment status through your my Social Security account at ssa.gov. If you don’t have an account yet, it’s worth creating one – you’ll be able to view your payment history, update your information, and receive important notices online.

Knowing your exact payment date helps you avoid late fees and manage your monthly expenses more effectively. Consider these tips:

Remember that if you receive Medicare Part B, the premium is typically deducted directly from your Social Security check. The standard Medicare Part B premium for 2026 is expected to increase to around $206.50 per month, up from $185 in 2025. This means the actual amount you receive after the Medicare deduction will be smaller than your gross benefit amount.

The Social Security Administration will mail COLA notices in late November 2025 showing your exact new benefit amount for 2026. You can also check this information in your my Social Security account’s Message Center.

The payment schedule for 2026 follows the same general pattern as previous years, with payments arriving reliably on set dates each month. By understanding how the schedule works and marking your specific payment dates, you can better manage your finances and ensure you’re prepared for each month’s expenses.

Whether you receive retirement benefits, disability payments, survivor benefits, or SSI, these scheduled payment dates provide the foundation for planning your financial life in 2026.

Author Credentials: Ian is the founder and Editor-in-Chief of Disabled World, a leading resource for news and information on disability issues. With a global perspective shaped by years of travel and lived experience, Ian is a committed proponent of the Social Model of Disability-a transformative framework developed by disabled activists in the 1970s that emphasizes dismantling societal barriers rather than focusing solely on individual impairments. His work reflects a deep commitment to disability rights, accessibility, and social inclusion. To learn more about Ian’s background, expertise, and accomplishments, visit his full biography.

Related Publications

• Guide to Social Security Payment Dates in 2026: Complete 2026 Social Security payment schedule with dates for retirement, disability, SSI benefits, and details on the 2.8% COLA increase for all recipients.

• 2026 COLA Brings 2.8% U.S. Social Security Increase: Social Security benefits increase 2.8% in 2026, adding average $56 monthly for 75 million Americans. Digital COLA notices available through my Social Security.

• 2026 Social Security COLA: What Retirees Should Expect: Experts project a 2.7% Social Security COLA for 2026, signaling modest inflation relief and a steady year ahead for retirees.

While we strive to provide accurate, up-to-date information, our content is for general informational purposes only. Please consult qualified professionals for advice specific to your situation.